nassau county property tax rate

What is the Nassau County Property Tax Rate. In November of 2019 the median pending sale price for a residential condominium or co-op property was 525000.

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

The tax rates for all the other taxing jurisdictions in which your property is located are added together and that.

. 86130 License Road Suite 3. How much are Nassau County taxes. The Tax Records department of the Treasurers Office maintains all records of and collects payments on delinquent Nassau County Property Taxes.

The median property tax also known as real estate tax in Nassau County is 871100 per year based on a median home value of 48790000 and a median effective property tax rate of. Whereas the typical New Yorker pays 123 a year in property taxes Nassau County residents pay on average 179 or roughly 8711 a year. Fernandina Beach FL 32034.

My Nassau Information Lookup. 6 rows The median Nassau County tax bill was 14872 in 2019. Nassau County Department of Assessment 516 571.

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Nassau County Homeowners Are Grieving and Winning Reductions in Their Property Taxes New statistics released by the Nassau County Legislature report that some. Hours of operation are 900am to 430pm Monday through Friday.

The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. There are plenty of reasons to buy a home in Suffolk County which sits at the eastern end of Long Island - but low property taxes is not one of them. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. When they moved into a new Plainview development last year residents like the Blattbergs thought property taxes on their two-bedroom apartment would be around 20000. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of.

Please enter the information below for the current tax year to view and pay your bill. If you are able please utilize our online application to file for homestead exemption. But not everyones situation.

Nassau County collects on average 179 of a propertys assessed. The Nassau County Treasurers Office has resumed in person access. What is the property tax rate in Nassau County.

What is the Nassau County Property Tax Rate. Nassau County Property Appraiser. Are taxes going up in Nassau County.

The deadline to file is March 1 2022. The typical Suffolk County homeowner pays. Nassau County 1 local option.

Without accounting for exemptions the. Nassau County has one of the highest. Pay Delinquent Property Taxes.

A year later it was 600000 a 143 percent increase. Enter your Address or SBL to get information on your. Purchases of tangible personal property made in other states by persons or business entities.

Nassau County Tax Collector. You can pay in person at any of our locations. Municipalities None 6 sales and use tax applies to.

What is the property tax rate in Nassau County NY. Taxes for village or city purposes and for school purposes are billed separately. In Nassau County the average tax rate is 224 according to SmartAsset.

Prior to visiting one of our. In Nassau County the average tax rate is 224 according to SmartAsset.

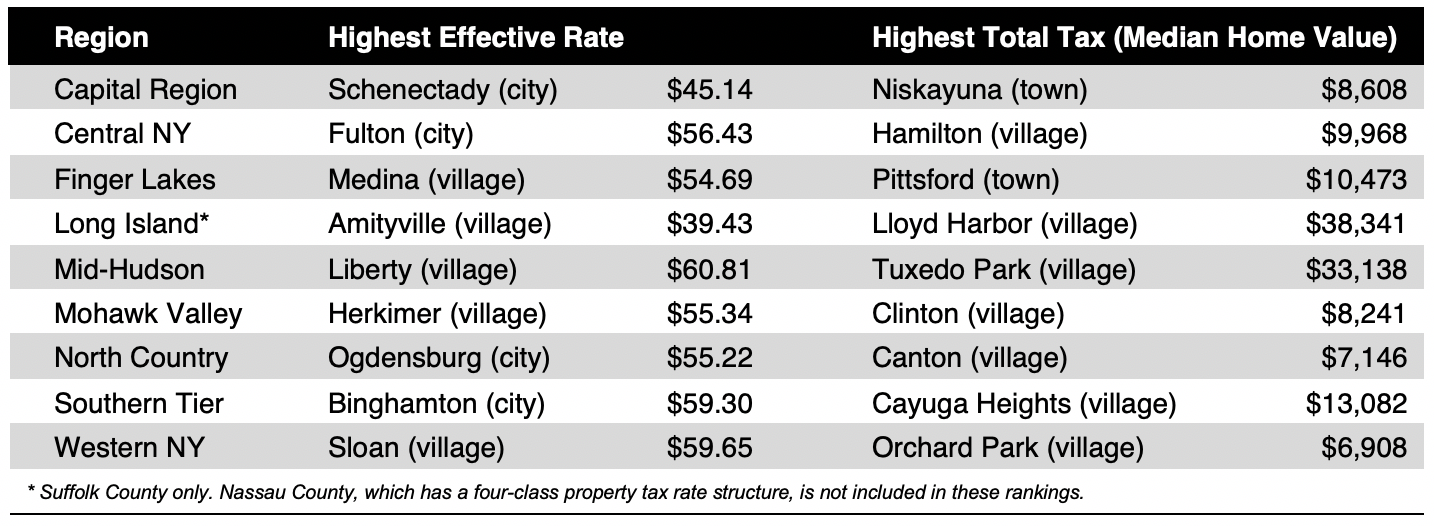

Compare Your Property Taxes Empire Center For Public Policy

Property Taxes In Nassau County Suffolk County

Property Tax By County Property Tax Calculator Rethority

Median Property Taxes By County Tax Foundation

Property Tax By County Property Tax Calculator Rethority

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

U S Property Taxes Levied On Single Family Homes In 2016 Total More Than 277 Billion Attom

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Nassau County Ny Property Tax Search And Records Propertyshark

Property Taxes By County Where Do People Pay The Most And Least

Property Taxes In Nassau County Suffolk County

2022 Property Taxes By State Report Propertyshark

It S Official The Investors Are Back Real Estate Investor We Buy Houses Mortgage Loan Originator

Sorting Through The Property Tax Burden Tax Policy Center

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

Fulton County Residents Who Live In A Home They Own May Be Able To Reduce Property Taxes By Making Sure They Are Ta Property Tax Mortgage Rates Property Values

Nassau County Named Safest Community In America By U S News Nassau County Nassau County